☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notice of 20212024

Annual Meeting

of Stockholders

and Proxy Statement

April 20, 202116, 2024

Carey Smith, Chair, President and Chief Executive Officer

Parsons Corporation

5875 Trinity Parkway #300

Centreville, Virginia 20120

To Our Fellow Shareholders:Shareholders

2020 will beImagine next. At Parsons, we create the future of national security and global infrastructure. We examine every element, including future customer needs, macroenvironment trends, technology evolution, and business model innovation to invent what has never been done. For 80 years, that momentum has driven Parsons forward, and we plan for it to fuel our success for the next 80 years.

Managing a transformational linear city driven by 100% renewable energy; applying artificial intelligence (AI) to determine a cyber adversary’s next move; creating innovative means to investigate and remediate emerging contaminants from surface water, groundwater, and soil; countering unmanned air systems; providing air base air defense; protecting critical infrastructure from cyber attacks; applying a commercial as-a-service business model to space command and control—80 years ago, these tasks would have astounded the world. Today, they are what Parsons is doing around the globe every day to imagine next.

Global Trends

We are in an unprecedented time. In national security, the United States is engaged in simultaneous conflicts abroad, preventing the proliferation of weapons of mass destruction, and countering cyberattacks against United States critical infrastructure, while carefully managing near-peer economic, diplomatic, and military ambitions. The US defense budget is projected to grow at a rate of 3% in the upcoming year, none of us will soon forget betweenand there is record investment in the research, development, test, and evaluation budget.

In parallel, the demand for global infrastructure is unprecedented, with shifting priorities, including sustainability, innovative financing, new trends post-COVID, resiliency, and technology application. According to Research and Markets, the global pandemic, politicalinfrastructure sector market is estimated at $2.57 trillion in 2023 and social unrest, widespread cyber-attacks,is projected to reach $3.48 trillion by 2028, for a compound annual growth rate of 6.27% from 2023 to 2028.

Parsons has the right team and the right portfolio at the right time. We are a solutions integrator that differentiates through advanced technology, including AI, cybersecurity, cloud-enabled solutions, and critical infrastructure protection. We have a unique and complementary portfolio at a time when critical infrastructure is under cyber attack and a company must both understand the domain and have the capabilities to protect it. Our dedicated global team consistently performs, and our status as a destination employer enables strong hiring and retention.

With a macroenvironment aligned to our six core markets of cyber and intelligence, space and missile defense, critical infrastructure protection, transportation, environmental remediation, and urban development, Parsons is able to deliver consistent results year-over-year and quarter-over-quarter for our shareholders. Our more than 18,500 employees are focused on executing our customers’ national security and infrastructure missions at a time when operationally relevant solutions are needed.

2023 Results

During our March 2023 Investor Day, we defined our strategy to move up the solutions integration value chain in our six end markets. Our strategy is working. Total revenue for fiscal year 2023 was $5.4 billion, which was a 30% increase from the prior year and was up 23% on an electionorganic basis. Fiscal year 2023 adjusted EBITDA of $465 million increased 32% from 2022, and adjusted EBITDA margin increased 13 basis points, to 8.5%. Operating cash flow for the full year increased 72%, to $408 million dollars. Ramping up new business wins, delivering on contract growth, and continued strong hiring and retention were key drivers to achieving these outstanding results. As a result of our strong performance, we saw stock price appreciation of 35.6% during the year.

In 2023, we set records for major financial metrics, including industry-leading organic revenue growth in both our Federal Solutions and Critical Infrastructure segments, total revenue growth, adjusted EBITDA which also grew faster than revenue, and all-time highs for cash flow and contract awards. These are the best results Parsons has delivered since our initial public offering.

Significant Accomplishments

– M&A: We completed three strategic acquisitions in 2023, two in our Critical Infrastructure segment and one in our Federal Solutions segment. Each brings enhanced and complementary capabilities to Parsons with immediate synergies.

– Win Rates: Parsons had record win rates, at 66% overall. The recompete win rate was unique to say the least. Our hearts go out to those who have suffered,93%, and we all look forwardhave now won four of our major recompetes, each valued at ~$2 billion, by securing the Federal Aviation Administration Technical Support Services Contract in 2023.

– Won 15 programs > $100 million,including the largest new business contracts we have ever won in both segments. Representative wins include the following:

Parsons had an outstanding 2020single-award classified contract for new and continued work in spitesupport of these events. Our strategythe US government

– Book-to-bill: We accomplished a trailing 12-month book-to-bill of 1.1x, and deliver on our customers’ missions.

For the year, we achieved record profitability and cash flow, acquired Braxton Science and Technology Group, and won large contracts.Critical Infrastructure segment had 13 consecutive quarters of > 1.0x book-to-bill. In addition to our $8.6 billion backlog, we have $14 billion in contracts that have been awarded but not yet booked.

– Recognition: We were recognized for our ethicsperformance, including placing as one of Engineering News-Record’s top three companies in four categories: program management, construction management, professional services, and IT leadership,program/construction for fee. We received the Development Project of the Year award for the Lusail City Residential Project in Qatar. Parsons EMEA was also recognized by both Dubai Municipality and ROSHN for exemplary consultancy and design services. The Office of the Director of National Intelligence gave us the National Intelligence Collection Award. The Department of Defense recognized us with our fourth mentor-protégé Nunn-Perry Award.

– Blue Grass/Pueblo chemical weapons elimination: Parsons was part of the team that helped the United States comply with the 1997 Chemical Weapons Convention agreement by destroying our country’s last chemical weapon.

– Achieved AS9100 certification: This is a testament to our aerospace quality management system.

– Delivered first Recovery of Airbase Denied by Ordnance (RADBO) system: Parsons delivered our first RADBO system, which included the first ground-based directed energy weapon system to be approved for production, to the Air Force.

Vision And Investment Thesis

Our vision is to move up the value chain as a solutions integrator that differentiates through advanced technology and to prime and win larger, more profitable contracts. Our mission is to deliver digitally enabled solutions in an operationally relevant time for our defense, intelligence, and infrastructure customers.

So, what makes Parsons different and why are we well as our employee-friendly practices. I am proudpositioned for the future?

– We have an experienced management team that delivers on commitments.

– Our people-first culture and mission focus attracts destination employees.

– All six of our employees’ performanceend markets are growing, enduring, and the way they represent Parsons.

We ended 2020profitable, each with estimated compound annual revenue within 1% of guidance, net income of nearly $100 million, and records for adjusted EBITDA, adjusted EBITDA margin, and cash flow (See “Company Performance Highlights” for a definition of adjusted EBITDA). We delivered net income margin of 2.5% and expanded adjusted EBITDA margins by 180 basis pointsgrowth rates over the past two years.next three years between 5% and 12%.

– We also exceededhave a distinguished national security portfolio positioned to deliver solutions that outpace near-peer threats.

– There is unprecedented global infrastructure spend, including $1.5 trillion in MEA, $1.2 trillion in the high end of our cash flow guidanceUS, and maintained our healthy$140 billion in Canada expected in the future.

– We have a favorable financial outlook and proven, effective capital deployment strategy. We have a strong balance sheet.

However, we were not completely immune fromsheet, and at the items mentioned in my opening paragraph. In terms of revenue, we were less than one percentage point below the low end of our 2020 guidance range and would have exceeded the high end of the range were it not for approximately $200 million of contract work deferredyear had low debt, enabling further acquisitions as a result of the COVID-19 pandemic.we enter 2024.

In terms of other key metrics, we maintained our solid backlog, which stands at two times our 2020 annual revenue, and our new contract bookings were 7% above our annual revenue, a strong indicator of future growth. In addition, we won large new contracts in both operating segments, which was driven by our investments in our technology, people, and recent acquisitions.Responsible Corporation

Key contract wins in 2020 included:

$1.2 billion Valley Line West Light Rail Transit project for the City of Edmonton, in Alberta, Canada

$224 million extension to the Riyadh Metro project, which is the largest ongoing metro project in the world

$307 million and $180 million contracts for classified work with classified customers

$51 million contract employing Parsons’ ZEUS™ directed-energy system, which can target at more than 300 meters and has enough power to detonate cluster bombs, land mines, and general-purpose bombs. This is the first DoD ground-based laser system placed into production.

Successfully Executing Acquisition Strategy While Maintaining Strong Balance Sheet

Late in the year, we acquired Braxton, which reinforces our position in the rapidly expanding space market and underscores our disciplined approach to M&A. We strive to acquire companies that operate in specific high-priority and high-growth markets. We also like to acquire companies that we’ve worked with in the past, that have a strong reputation in the market, and that benefit from our scale and broader set of capabilities. Braxton perfectly aligns with this aspect of our M&A strategy. In addition, we ensure our M&A candidate companies have great technology, exceptional management teams, and are a strong fit with our agile and innovative culture. Braxton also meets these objectives.

Braxton exceeded all of our major financial criteria, as well, with revenue growth and adjusted EBITDA margins above 10%, and is accretive. Braxton enhances our margin and revenue growth profile and further strengthens our strategy to win large prime contracts within the DoD and intelligence communities.

Our disciplined M&A approach and robust cash flow enabled us to maintain our strong balance sheet. We generated cash flow of $289 million for the year and ended 2020 with a net leverage ratio of approximately 0.3x. Our low leverage and over $500 million of undrawn revolver capacity, will enable us to continue to make strategic investments in accretive acquisitions, R&D, our people, and our culture.

Doing the Right Thing

In addition to successfully executing on our strategy, Parsons has an 80-year history of cultivating a longstanding commitment to integrity, diversity and inclusion, and doing the right thing. These are two ofresponsible enterprise. Driven by our core values, as an organization. We are a smarterParsons has long been recognized for excellence in corporate citizenship. 2023 continued that legacy of recognitions and stronger company when we all work together. Attention to environment, social, and governance (ESG) excellence remains a critical component of our culture and ability to drive shareholder value. In 2020, we took steps to elevate our ESG work, which began at the Board level. The Corporate Governance and Responsibility Committee took on the additional oversight of economic, environmental, and social topics and was renamed the Corporate Governance and Responsibility Committee. We felt this was an important step to reinforce our commitment to delivering a better world.

We also have a culture of continuous improvement, which includes revisingadvancing sustainability, equity, and updating our Code of Conduct and human rights policies, modifying and streamlining our supplier diversity process, extending our sustainability practices, and supporting our employees and their well-being.engagement. In addition, we have invested in our communities through our employee-driven2023, Parsons Gives Back program. Even with the limitations of a global pandemic, our teams rose to the challenge and found new and innovative ways to give back to communities, including blood donations, support for schools going online, clean-up efforts, homeless outreach and food donations, and supporting US military veterans and their families, just to name a few.

We are also proud of the various awards and recognition we received in 2020, including:

Ethisphere Institute recognition in 2020 aswas named one of the World’s Most Ethical Companies by Ethisphere for the eleventh14th consecutive year, reinforcing the critical importance of ethics and integrity in driving our culture of performance. That success is built on our active participation in the communities where we live and work, supporting organizations like the Tragedy Assistance Program for Survivors (TAPS), where we have raised $1.3 million in support of military families in the 16 years of our partnership; in 100 employees volunteering a total of 450 hours to support global technology education nonprofit Technovation in its efforts to advance women in STEM; and in a rowglobal back-to-school fundraiser where we supported 1,300 students in communities where we work with school supplies, meals, and uniforms. In total, Parsons employees logged more than 35,000 volunteer hours in 2023, a company record which illustrates our commitment to being a responsible partner.

In 2023 we announced our commitment to set near- and long-term targets for Greenhouse Gas (GHG) emissions aligned with 1.5C and net-zero through the Business Ambition for 1.5C campaign, a leading global coalition committed to taking urgent climate action.

Our initiatives have been recognized by leading organizations, including the following:

Forbes recognition as oneBest of the World’s Best Employers

A perfect score of 100 on the Human Rights Campaign Foundation Corporate Equality Index for active support and inclusion of the LGBTQ+ community

Honored by the Virginia DepartmentThe Future

In a world of uncertainty and change, our strategy for the Blindfuture remains constant and Vision Impaired for excellencefocused on continuing to move up the value chain in access for disabled persons

Named a Best for Vets Employer – 2020 by Military Times, as one of the country's best employersour six well-funded and organizations with military-connected employment programs, benefits,growing core end markets. Our expertise in innovative technologies, our mission-focused ethos, and support efforts

Namedour commitment to the CIO 100 list of the world's most innovative companies

Looking Forward

2020 was another successful year, producing record results for adjusted EBITDA, margins, and cash flow in spite of headwinds, primarily from COVID. We also successfully delivered onsolving our customers’ critical missionstoughest challenges, as outlined in our strategy, are the foundation for our future. While no one can predict the future, we can certainly imagine next and executed our growth strategy, while maintainingknow that digital technology, particularly AI and cyber, will play a strong balance sheet to support additional investments in organic growth and acquisitions. We are excited about our future and confident our diversified portfolio is aligned with the Biden Administration’s priorities for national defense, infrastructure, and environmental initiatives. significant role.

In closing, I want to thank the employees of Parsons Corporation for delivering results for our customers and shareholders in 2023. It is our mission plus our unique culture that engage and excite our employees shareholdersto imagine next.

Carey Smith

Chair, President, and customers for their continued loyalty and dedication. Without your support, we could not have achieved our goals, and together we will continue to drive future shareholder value as we collectively deliver a better world. CEO

/s/ Charles H. Harrington

Charles H. Harrington

Chairman/CEO

NOTICE OF PARSON’SPARSONS CORPORATION 20212023 ANNUAL MEETING OF STOCKHOLDERS

Time and Date: | 9:00 a.m. (EDT), April | |

Place: | Virtual Meeting accessible via: www.virtualshareholdermeeting.com/ | |

Agenda: | 1. The election of four director nominees named in the proxy statement; | |

2. The ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the Company’s fiscal year | ||

3. A non-binding advisory vote on the compensation program for the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis section of the proxy statement; and | ||

4. The transaction of any business that may be properly brought before the annual meeting. | ||

The Board of Directors recommends that you vote FOR Proposals 1, 2, and 3. | ||

Record Date: | Only holders of record of the Company’s common stock on February | |

Date of Distribution: | This proxy statement and the accompanying materials are being mailed to stockholders on or about March | |

Proxy Voting: | Your vote is important. Whether or not you plan to attend the annual meeting, you may access electronic voting via the Internet or the automated telephone voting feature, both of which are described on your enclosed proxy card, or you may sign, date, and return the proxy card in the envelope provided. If you plan to attend the annual meeting, you may vote in person. | |

On Behalf of the Board of Directors,

/s/ Michael R. Kolloway

Michael R. Kolloway

Chief Legal Officer and Secretary

March 10, 20213, 2024

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on April 20, 2021:16, 2024. This Notice of Annual Meeting and Proxy Statement and our 20202023 Annual Report are available at www.parsons.com.

TABLE OF CONTENTS TOTO PROXY STATEMENT

1 | ||||

| ||||

| ||||

| ||||

| ||||

| ||||

CORPORATE GOVERNANCE AND GENERAL INFORMATION CONCERNING THE BOARD OF DIRECTORS AND ITS COMMITTEES |

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

15 | ||||

| ||||

| ||||

| ||||

18 | ||||

18 | ||||

| ||||

| ||||

| ||||

| ||||

| ||||

COMPENSATION AND MANAGEMENT DEVELOPMENT COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION |

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

Indemnification Agreements and Directors’ and Officers’ Liability Insurance |

| |||

| ||||

i

26 | ||||

| ||||

| ||||

| ||||

i

74 | ||||

ii

| ||||||

IMPORTANT INFORMATION ABOUT ANNUAL MEETING AND PROXY PROCEDURES |

| |||||

A-1 |

| |||||

ii

iii

This summary highlights certain information contained elsewhere in this proxy statement. The summary does not contain all of the information that you should consider, and you should review our Annual Report on Form 10-K for the year ended December 31, 20202023 and the entire proxy statement carefully before voting.

Unless the context otherwise requires, (i) the terms “Parsons,” “the Company,” “we,” “us” and “our” refer to Parsons Corporation and its consolidated subsidiaries, (ii) “our Board” or “the Board” means the Board of Directors of the Company; (iii) “stockholder” means holders of our common stock; and (iv) “you,” “your,” “yours,” or other words of similar import in this proxy statement refers to stockholders entitled to vote on the matters to be presented at the annual meeting.

20212024 Annual Meeting of Stockholders

Date and Time: | April | |

Place: | Virtual Meeting (www.virtualshareholdermeeting.com/ | |

Record date: | February | |

Admission: | Annual meeting admission is limited to our registered and beneficial stockholders as of the record date and persons holding valid proxies from stockholders. Admission to our annual meeting requires proof of your stock ownership as of the record date, and valid, government-issued identification. See “Important Information about Annual Meeting and Proxy Procedures” in this proxy for additional information. | |

Voting Matters and Board Recommendations

Stockholders are being asked to vote on the following matters at the 20212024 Annual Meeting of Stockholders:

Proposal | Description | Board’s Voting

| Page |

No. 1 | Election of four | FOR each nominee |

|

No. 2 | Ratification of appointment of PricewaterhouseCoopers LLP (“PwC”) as the Company’s independent registered accounting firm for fiscal year | FOR |

|

No. 3 | A non-binding advisory vote on the compensation program for the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis (“CD&A”) of the proxy statement | FOR |

|

1

How to Vote

Stockholders as of the record date may vote in person at the meeting or vote in advance by submitting a proxy by Internet, telephone, or mail as follows:

In person by attending the Annual Meeting and following the instructions provided in the Notice;

Via the Internet by following the instructions provided in the Notice;

If you request printed copies of the proxy materials by mail, by filling out the proxy card included with the materials; or

By calling the toll-free number found on the proxy card or the Notice

Company Performance and 20202023 Highlights

We are very proud of our accomplishments in 2020:2023:

Record Revenue of $3.9$5.4 billion which includes $200 million of adverse impact from COVID-19

Net income of approximately $99$161.1 million

AdjustedRecord adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”) of $343$464.7 million

Adjusted EBITDA margin expanded of 8.7%

CashRecord cash flow from operating activities of $289$408 million

Completed oneAchieved significant Federal Solutions acquisition: Braxton Science & Technology Group

|

Completed the acquisitions of IPKeys Power Partners, Inc. and I.S. Engineers LLC to enhance our capabilities in critical infrastructure protection and transportation engineering and to position the company for projects receiving transportation funding under the Infrastructure Investment and Jobs Act between 2024 and 2026

Moved 90% of our workforce to safely and efficiently serve our customers

We calculate adjusted EBITDA as net income attributable to Parsons Corporation, adjusted to include net income attributable to noncontrolling interests and to exclude interest expense (net of interest income), provision for income taxes, depreciation and amortization and certain other items that we do not consider in our evaluation of ongoing operating performance. These other items include, among other things, impairment of goodwill, intangible and other assets, interest and other expenses recognized on litigation matters, amortization of deferred gain resulting from sale-leaseback transactions, expenses incurred in connection with acquisitions and other non-recurring transaction costs, equity-based compensation, and expenses related to our corporate

2

restructuring initiatives. EBITDA and adjusted EBITDA are non-GAAP metrics, and we include a reconciliation of both EBITDA and adjusted EBITDA to net income for fiscal years 20192023 and 20202022 as Appendix A. It is an important component of our compensation programs described in this proxy statement.

Our Board of Directors

This year’s Board nominees include four current Class II Directors—Mark K. Holdsworth, Steven F. Leer, M. Christian Mitchell, and David C. Wajsgras. Each nominee is listed below along with the continuing Directors,and you can find additional information under “Proposal 1: Election of Directors” beginning on page 6.7.

Corporate Governance Highlights

NineIn 2023, nine of our current eleven Directors arewere independent, and the Audit and Risk, Compensation and Management Development, and Corporate Governance and Responsibility Committees are 100% independent.

Our Board of Directors reflects diversity in gender, (three females), ethnicity, experience, qualifications, attributes, and skills.

The Board undertakes an annual evaluation of its performance, and each Committee of the Board undertakes an annual evaluation of the Committee’s performance and of the adequacy of its charter.

The Board of Directors holds regular executive sessions of non-management Directors.

The Board of Directors conducts an annual discussion on management and level 2 leadership succession planning.

Our investor relations team and management teams regularly engage with current and potential investors.

Note: Mark Van Andel to update In 2023, Parsons has implemented executive officerelected to disclose information related to our climate-related governance, risk management and director stock ownership guidelines.

AdditionThe Charter of responsibilities forthe Compensation and Management Development Committee was amended to confirm the Committee’s ability to claw back executive compensation in conformance with the Dood-Frank Act.

3

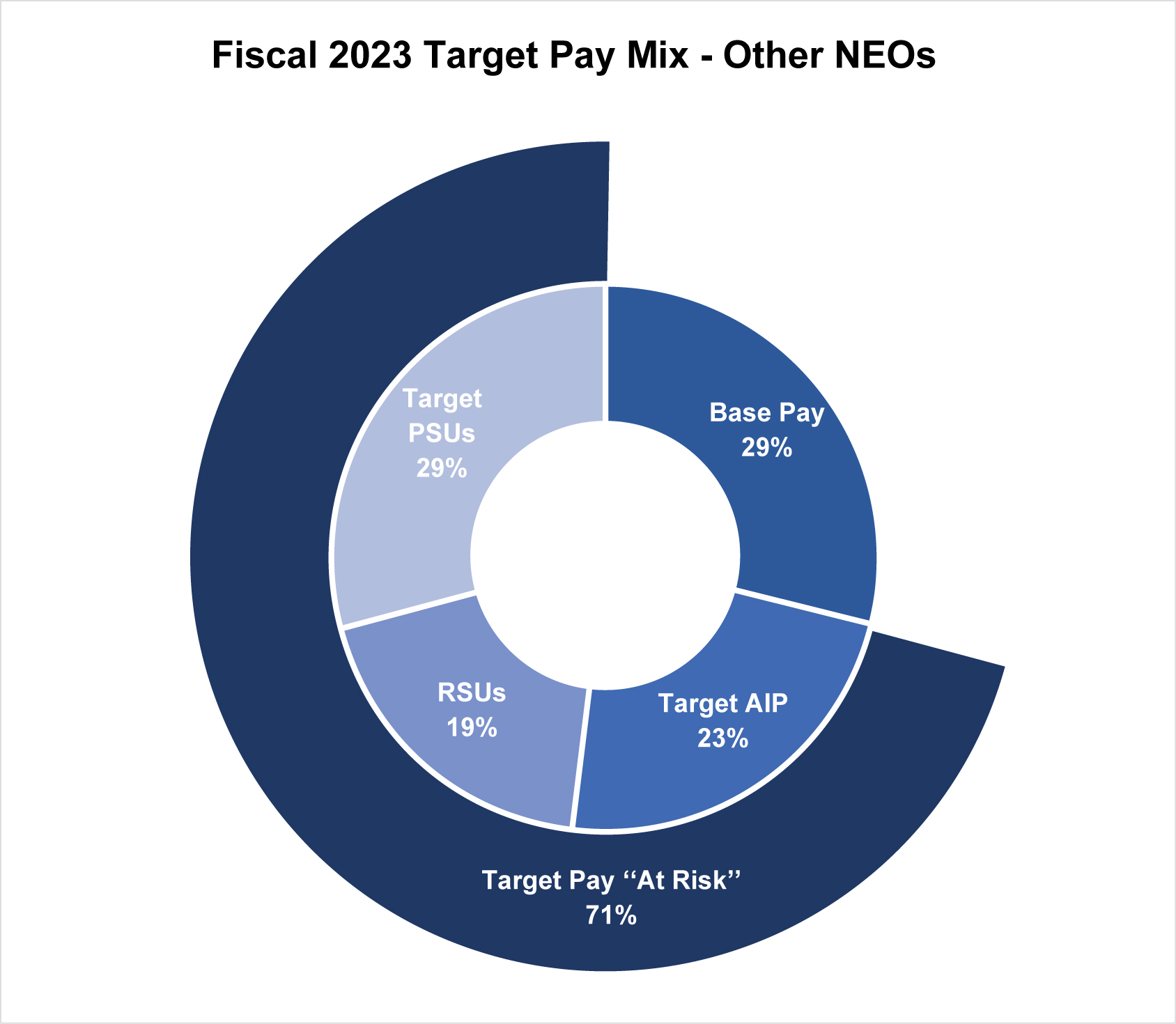

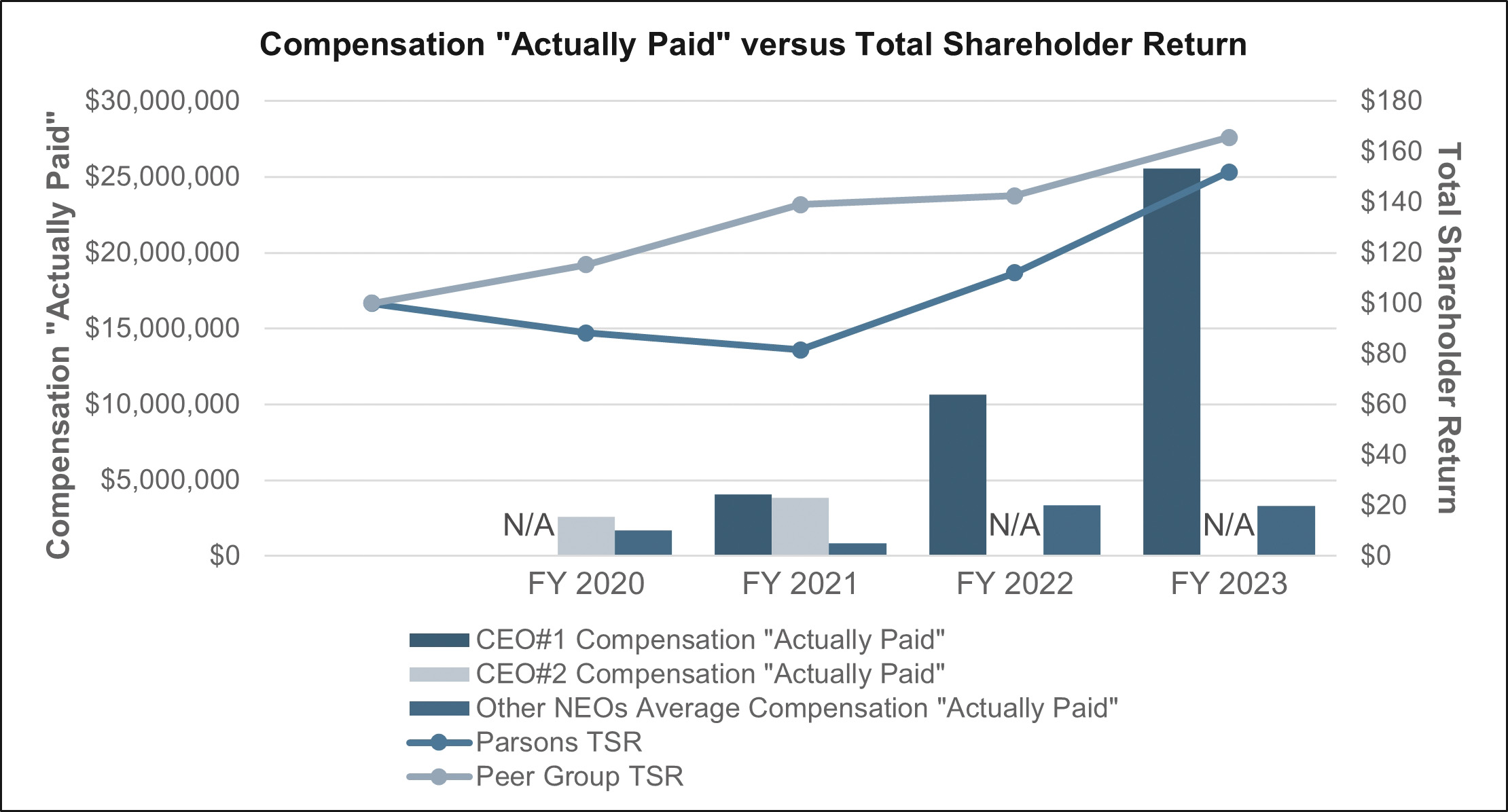

Executive Compensation Highlights

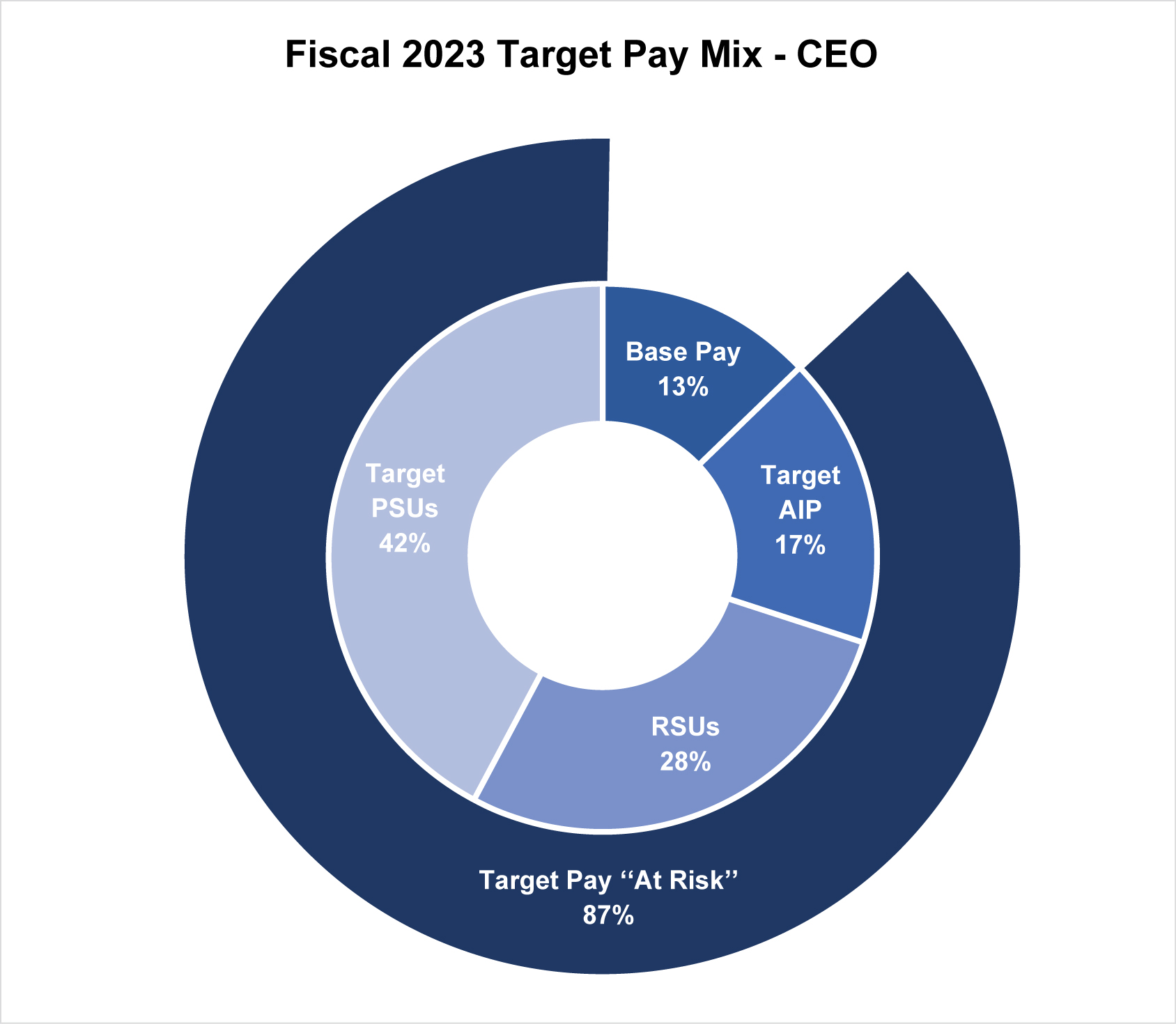

Together with our Compensation and Management Development Committee, we are committed to designingmanaging a compensation program that is competitive and aligns the interests of our executives with the long-term interests of our stockholders. We continuously seek to evolve our approach and stay connected with the views of our stockholders.

Our executive compensation programs and policies are intendedhave been designed to support the development and performance of a strong executive team who are provided with appropriate incentives that supportalign with our business strategy and values, buildattract and retain top talent and address different risks associated with compensation. We strive to provide a total compensation package that fairly and equitably rewards our senior leadership as a team and as individuals, from each of whomwhich we expect superior performance.

We have designed our executive pay programs to reward executives for positive company performance and align their interests with those of our stockholders by having a significant portion of compensation composed of performance-based or “at-risk” compensation. We

provide an appropriate balance of short- and long-term compensation, with payouts based on the Company’s achievement of certain objective financial and non-financial metrics. We have structured our short-term incentive opportunities to focus on the achievement of specific annual financial objectives that will further our longer-term growth objectives. We use our long-term incentive compensation to provide incentives for our executive team to focus on the growth of our overall enterprise value and, correspondingly, to create value for our employee stockholders.

|

In designing and implementing our executive compensation programs, we follow practices that promote goodproper governance and serve the interests of our stockholders, with maximum payout caps in place for annual cash incentives and long-term performance awards.

For more details on our compensation program, please see our discussion in the CD&A section of this proxy.

Corporate Citizenship Highlights

We are committedImagine Next extends to beingour commitment to imagining what’s next for the communities where we live and work. Driven by our core values – safety, quality, innovation, sustainability, integrity, and diversity – and underpinned by our CARE (Cultivating a good corporate citizen with an Environment, Social and Governance (“ESG”) ethos focused on our corporate quest to Deliver a Better World through disruptive technology solutions. We take great pride in our human capital management, including building a diverse work environment, supporting lifelong employee learning, and contributing to charitable and community causes through Responsible Enterprise) strategy,our Parsons Gives Back Program. program outlines our active charitable and engagement support to communities and organizations towards imagining a safer, healthier, more connected, and more secure world.

4

Our Parsons Gives Back efforts are employee drivenemployee-driven and focused on veteran/military, Educational/STEM Outreach, and Vibrant Communities causes. The Corporate Governance and ResponsibilityCG&R Committee of the Board oversees Parsons Corporation’s ESG efforts and receives regular reports from the Chief Corporate Affairs Officer.Business Operations Officer and ESG vice president.

Recognitions and initiatives include:

|

We were recognized by the |

The Defense Department recognized Parsons (Polaris Alpha®) with the James S. Cogswell Industrial Security Achievement Award, which honors outstanding participation and compliance with the National Industrial Security Program.

Our 2020 Corporate Social Responsibility Report titled “Believe in Better” transparently documents our ESG efforts underpinned by our core values of Safety, Quality, Integrity, Diversity, Innovation, and Sustainability. Our ESG website at parsons.com/care, “Cultivating a Responsible Enterprise”, provides a comprehensive description of our enterprise wide ESG strategy and efforts.

We received Nunn-Perry award, recognizing outstanding achievement in the Department of Defense (DoD) Mentor-Protégé Program, for our mentor-protégé agreement with a woman-owned, service-disabled veteran owned small business and Alabama State University.

Members of our IT team participated in a virtual coding marathon, 48 in 48. They had 48 hours to create a 10-page website for a non-profit organization. The Parsons’ team was matched with the Chicago Tap Theater, a non-profit dance theater that highlights the rich history and inclusivity of tap dance and offers classes to children who are deaf or hard of hearing.

|

|

2020 Annual Top 50 Employers List in STEM Workforce Diversity Magazine (5 years)

Employer Support of the Guard and Reserve (ESGR) Recognition

Annual Top 50 Employer Minority Engineer Magazine (8 years)

Annual Top 50 Employers Woman Engineer Magazine (2 years)

|

|

Forbes has recognized Parsons Corporation as one of the World’s Most Ethical Companies for the 14th consecutive year. The World’s Most Ethical (WME) Companies assessment is based upon the Ethisphere Institute’s Ethics Quotient (EQ) framework, which offers a quantitative way to assess a company’s performance in an objective,consistent and standardized manner. Scores are generated in five key categories: ethics and compliance program,culture of ethics,corporate citizenship and responsibility, governance and leadership, and reputation.

Our commitment to enhancing diversity, equity and inclusion as fundamental to our corporate culture is evident through our support of active duty and veteran employees (MILVET), employees in the LGTBQ+ community (PRIDE Alliance), employees of African/American heritage (BELONG),employees of Hispanic/Latino heritage (HOLA), Parsons’Women’s Roundtable (PWR), and employees of Asian and Pacific Islander heritage (SOAR), and their allies. Parsons also launched its seventh employee resource group, the Formation of Rising Career Employees (FORCE), designed to provide a supportive community for employees who are in the early stages of their careers at Parsons.

5

Other notable recognitions include:

•

6

PROPOSAL 1: ELECTIONELECTION OF DIRECTORS

Our Board of Directors currently consists of eleven members. In accordance with our certificate of incorporation, our Board of Directors are divided into three classes with staggered three-year terms. At each annual meeting of stockholders after the initial classification, the successors to the Directors whose terms will then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election. Our current Directors are divided among the three classes as follows:

The Class I Directors are Letitia A. Long, James F. McGovern, Harry T. McMahon and Carey A. Smith, and their terms will expire at the 2026 annual meeting of stockholders in 2023; provided, that Mr. McGovern’s term will end at the 2022 annual meeting of stockholders due to his reaching the corporation’s mandatory retirement age;

The Class II Directors are Mark K. Holdsworth, Steven F. Leer, M. Christian Mitchell, and David C. Wajsgras, and their terms will expire at the 2021annual meeting of stockholders to be held on April 16, 2024. Directors Holdsworth, Leer, Mitchell, and Wajsgras are seeking re-election at the 2024 annual meeting of stockholders; and

The Class III Directors are CharlesGeorge L. Harrington, GeneralBall, Ellen M. Lord, Darren W. McDew, (USAF, Ret.) and Major General Suzanne M. Vautrinot, USAF (ret), and their terms will expire at the 2025 annual meeting of stockholders to be held in 2022.

Any increase or decrease in the number of Directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the Directors. This classification of our Board of Directors may have the effect of delaying or preventing changes in control of our company.

The four nominees for election as Class II Directors are listed below. If elected, the nominees for election as Class II Directors will serve for a term of three years and until their successors are elected and qualify. Unless you instruct us on the proxy card to vote differently, we will vote signed, returned proxies FOR the election of such nominees. If for any reason any nominee cannot or will not serve as a Director, we may vote such proxies for the election of a substitute nominee designated by the Board.

To be elected in, a nominee must receive a plurality of the votes cast. The Corporate Governance and Responsibility Committee and the Board believe that each Class III Nominee brings a strong and diverse set of skills and experiences to the Company, including significant government, public company, financial, and strategic experience, that strengthen our Board’s independent leadership and effectiveness with respect to our business and long-term strategy. The Class II Nominees are as follows:

7

Mark K. Holdsworth (Class II)

Age: Director Since: 2006

• Corporate Governance & Responsibility • Compensation &

| Mark K. |

Steven F. Leer (Class II)

Age: Director Since: 2013

• Audit and Risk • Compensation & Management Development |

| Steven F. Board Skills Matrix set forth in this Proxy Statement. |

8

M. Christian Mitchell (Class II)

Age: Director Since: 2011

• Audit and Risk • Corporate Governance & Responsibility |

| M. Christian Mitchell |

David C. Wajsgras (Class II)

Age: Director Since: 2020

• Audit and Risk • Compensation & Management Development |

| David C. Wajsgras |

The Board of Directors recommends a vote FOR each of the Class II nominees. |

9

CONTINUING DIRECTORS

The seven Directors whose terms will continue after the annual meeting and will expire at the 20222025 annual meeting (Class III) or the 20232026 annual meeting (Class I)II) are listed below.

(Class III)

Age: Director Since:

|

|

Ellen M. Lord (Class III)

Age: 64 Director Since: 2022 Committees: • Compensation & Management Development • Corporate Governance & Responsibility | Ellen M. Lord served as the Under Secretary of Defense for Acquisition and Sustainment for the industrial industries. |

10

Gen Darren W. McDew

(Class III)

Age: Director Since: 2020 Committees: • Corporate Governance & Responsibility • Compensation & Management Development |

| Gen. Darren W. McDew (USAF, Ret.) served |

|

|

|

|

Major General Suzanne M. (Class III)

Age: Director Since: 2014

• Audit and Risk • Corporate Governance & Responsibility | Major General Suzanne M. “Zan” Vautrinot, (USAF, Ret.) |

11

Letitia A. Long (Class I)

Age: 64 Director Since: 2020 Committees: • Audit and Risk • Corporate Governance & Responsibility | Letitia A. Long currently serves as chairwoman of the board of directors of the Intelligence and National Security Alliance (INSA). Ms. Long previously served as Director of the National Geospatial-Intelligence Agency from 2010-2014 and as Deputy Director of the Defense Intelligence Agency, Deputy Undersecretary of Defense Intelligence (Planning, Policy & Resources), and Deputy Director of Naval Intelligence for the Department of Defense. Ms. Long serves on the board of directors of T-Mobile U.S., and COPT Defense Properties and is a member of the National Geospatial-Intelligence (NGA) Advisory Board. Ms. Long is member of the Virginia Tech Board of Visitors and provides mentoring and advisory work for the government on space and special reconnaissance programs and has remote earth sensing and geospatial intelligence experience. Ms. Long previously served on the board of directors of Raytheon Company, now part of Raytheon Technologies, from 2015 until 2020 and chaired the Public Policy and Corporate Responsibility Committee. Ms. Long was awarded NACD Directorship 100 in 2020 and was elected to the Virginia Tech Academy of Engineering Excellence. She received her bachelor-of-science degree in electrical engineering from Virginia Polytechnic Institute and State University and her master-of-science degree in engineering from The Catholic University of America. | |

Harry T. McMahon (Class I)

Age: 70 Director Since: 2018 Committees: • Audit and Risk • Compensation & Management Development | Harry T. McMahon spent 32 years in investment banking and has broad experience providing strategic and financial solutions for corporations and institutions worldwide. This includes leading teams on mergers and acquisitions and corporate finance advisory projects, many of which involved industries adjacent to Parsons Corporation, such as infrastructure, engineering, aerospace and defense, enterprise technology, and federal services. He previously served as co-head of Global Corporate Finance at Merrill Lynch and then as Executive Vice-Chairman of Bank of America. He currently serves as a director of Direct Relief, a global provider of humanitarian aid, and as a trustee of Claremont McKenna College, where he previously served as chairman of the board. He earned a bachelor-of-arts degree and honorary doctorate from Claremont McKenna College and a master-of-business administration from the University of Chicago Booth School of Business. | |

12

Carey A. Smith (Class I)

Age: 60 Director Since: 2020 | Carey A. Smith was elected the President and Chief Executive Officer of Parsons Corporation in July 2021 and Chair of the Board of Directors effective April 14, 2022. Ms. Smith joined Parsons in 2016 as President of our Federal Solutions business and has had progressive roles as the company’s Chief Operating Officer, and President and Chief Operating Officer. During her tenure, Ms. Smith has driven Parsons’ transformation into a balanced federal and infrastructure portfolio and moved the company up the solutions integration value chain. Prior to joining Parsons, Ms. Smith held a series of escalating executive leadership roles within the aerospace and defense industry at both Honeywell and Lockheed Martin, including serving as Honeywell’s President of the Defense and Space business unit. She serves on the board of directors of Edison International, the Professional Services Council non-profit, where she previously served as chair of the board of directors, and the Saudi-Arabia Parsons Ltd (SAPL). Ms. Smith’s recognitions include being a six-time recipient of the Executive Mosaic Wash100, four-time recipient of the WashingtonExec “Top Execs to Watch”,Virginia 500 Power List, top 5 COOs in Government Contracting, Ohio Northern University Alumni of the Year, and Marlington High School Alumni of the Year. In 2023, Ms. Smith was recognized as the GovCon Executive of the Year. Ms. Smith received an honorary doctorate degree from Ohio Northern University, a master’s degree in electrical engineering from Syracuse University and a bachelor-of-science degree in electrical engineering from Ohio Northern University. She has NACD Directorship (NACD.DC) and cyber certifications. |

13

CORPORATE GOVERNANCE AND GENERAL INFORMATION CONCERNING THE BOARD OF DIRECTORS AND ITS COMMITTEES

Our Board and Leadership Structure

Our Board currently consists of eleven Directors, nine of whom are independent. There are no family relationships among our executive officers and Directors. Each incumbent member of the Board attended or participated in 75%90% or more of the aggregate of (i) the total number of meetings of the Board (held during the period for which such person has been a Director) and (ii) the total number of meetings held by all Committees of the Board on which such person served (during the periods that such person served).

Our Board of Directors recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide effective oversight of management. Our bylaws and corporate governance guidelines provide our Board of Directors with flexibility to combine or separate the positions of ChairmanChair of the Board of Directors and Chief Executive Officer.Officer (CEO). Our Board of Directors currently believes that our existing leadership structure is effective, provides the appropriate balance of authority between independent and non-independent Directors, and achieves the optimal governance model for us and for our stockholders.

Mr. Harrington serves as our Chief Executive Officer and Chairman of the Board of Directors. Our Board believes that Mr. Harrington’s services as Chairman of the Board of Directors is in The Chair/CEO has the best interest of the Company and its stockholders. Mr. Harrington possesses detailed and in-depthin depth knowledge of the issues,company’s opportunities and challenges, we face and is thus best positioned to developdevelops agendas that ensure that the Board of Directors’Board’s time and attention areis focused on the most critical matters. Specifically, his combined role enables decisive leadership, ensures clear accountability,matters, and enhances our ability to communicate our message and strategy clearly and consistently to our stockholders, employees, customers and manufacturers.employees.

Ms. Smith serves as our Chair of the Board of Directors.

Our corporate governance guidelines provide that we have a lead independent Director. Our lead independentLead Independent Director is JamesSteven F. McGovern.Leer. In that role, he callshas called meetings of the independent Directors and chairschaired such meetings, including all executive sessions of the Board of Directors, facilitatesfacilitated communications between our ChairmanChair and the independent Directors of the Board of Directors, and reviewsreviewed the quantity, quality and timeliness of information provided to the Board, among other duties described in our corporate governance guidelines.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines. The Board and the Corporate Governance and Responsibility Committee are responsible for reviewing and amending these guidelines as they deem necessary and appropriate. The Corporate Governance and Responsibility Committee is responsible for overseeing the system of corporate governance of the Company and the corporation’s environment, social and governance initiatives. The Corporate Governance and Responsibility Committee has reviewed and approved an updated Skills Matrix for Board members (which is included in this proxy statement) and to reflect the Committee’s oversight of climate-related initiatives and documentation. The Corporate Governance Guidelines are available without charge on the Investor Relations portion of our website, www.parsons.com.

We have adopted written codes of conduct and ethics that apply to our Directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting

officer or controller, or persons performing similar functions, and to third parties with whom we conduct business, including agents, representatives, joint venture partners, consultants and subcontractors. We have posted current copies of these codes on our website, www.parsons.com. In addition, we will post on our website all disclosures that are required by law or NYSE listing standards concerning any amendments to, or waivers from, any provision of the codes.

Board Meetings and Attendance

Directors are expected to attend each Board meeting, each meeting of the Committees on which they serve, and the Annual Meeting of Stockholders. During fiscal year 2020,2023, the Board held seven meetings and acted by written consent. Each of our Directors who served as a Director during fiscal 20202023 attended 75%90% or more of the aggregate total number of meetings of the Board (during the time in which they served) and the Board Committees on which he or she served that were held during the time he or she was a director in fiscal 2020. Ms. Smith was appointed to the Board in December 2020 after the final Board meeting for 2020 and, thus, did not participate in any Board meetings during 2020.2023.

Although management is responsible for the day-to-day management of the risks our company faces, our Board of Directors and its Committees take an active role in overseeing the management of our risks and bear the ultimate responsibility for of risk management. The Board of Directors regularly reviews information regarding our operational, financial, legal, data security and strategic risks. Specifically, senior risk management attendspersonnel attend quarterly meetings of the Board, providesprovide presentations on operations including significant risks, and isare available to address any questions or concerns raised by our Board of Directors.

In addition, our four Board of Directors’ Committees assist the Board of Directors in fulfilling its oversight responsibilities in certain areas of risk. The Audit and Risk Committee coordinates the Board of Directors’ oversight of our internal control over financial reporting, disclosure controls and procedures, risk, related party transactions, code of conduct, data and information security. The Compensation and Management Development Committee assists the Board of Directors in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs as well as succession planning as it relates to our Chief Executive Officer and executive leadership. The Corporate Governance and Responsibility Committee assists the Board of Directors in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure, succession planning for our Directors, and corporate environment, social, and governance (ESG)ESG matters. The Executive Committee assists the Board of Directors in conducting its duties, including meeting with greater frequency than the Board of Directors in connection with key actions to be taken by us, such as major acquisitions, divestitures, mergers or changes in capital structure or ownership, in addition to meeting on an ad hoc basis in order to review major investments or divestitures outside of our normal investment plan. When any of the Committees receives a report related to material risk, the chairmanchair of the relevant Committee will report on the discussion to the full Board of Directors.

Information and Security Risk

Our Chief Security Officeand Risk Officer is responsible for the development, delivery and maintenance of enterprise information, security and risk management programs which safeguard Parsons’ business information, assets, and its supporting infrastructure against unauthorized use, disclosure, modification, damage or loss. Our Security Operations Centers provide continuous monitoring of information systems to prevent, detect, and respond to cyber events.events and to engage with our Chief Legal Officer to discuss such responses and any appropriate disclosure requirements. We also provide training to our global workforce on cyber security awareness, including: Cyber Security Awareness Month,including online

training courses, and interactive discussions on information security.security, and a key role on the corporation’s critical response management committee. Our security control protocols map directly to multiple security compliance frameworks, including ISO 27001, Sarbanes-Oxley, DFARS (NIST 800-171), Cybersecurity Maturity Model Certification, and stringent privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).A full description of the Corporation’s procedures for managing and disclosing cyber-security risks and incidents can be found in Section 1C of the Corporation’s 10-K filed with the Securities and Exchange Commission on February 14, 2024.

Annual Board Performance Assessment

The Board and each of the Audit and Risk, Compensation, and Corporate Governance and Responsibility Committees perform annual assessments of their operations and effectiveness and set goals for the future.

During 2020,2023, the Board and the Committees engaged inperformed an annual assessment process in which each memberinternal self-assessment. The Corporate Governance and Responsibility Committee reviewed the results from prior assessments and considered the business goals and developments of the company in 2020. Each Director and Committee member consideredevaluated the skills, industry and public company experience, independence, and diversity of the Board to allow usand provided feedback for the Board to achieve our business, governance and sustainability objectives. The Lead Independent Director and the Chair of the Corporate Governance and Responsibility Committee and the Lead Independent Director led a discussion of achievements during 20202023 and goals and objectives with the Board.

16

The Skills Matrix reviewed and approved by the Corporate Governance and Responsibility Committee, and the full Board of Directors, is referenced below.

In 2021, an assessment will be performed by an external vendor.

|

|

|

|

|

|

|

|

|

|

|

|

Knowledge, Skills and Experience1 | |||||||||||

End Market Background | |||||||||||

Defense |

|

|

|

|

|

|

| ||||

Intelligence |

|

|

|

|

|

|

| ||||

Infrastructure |

|

|

|

|

|

|

| ||||

Technical Skills and Expertise | |||||||||||

Financial |

|

|

|

|

|

|

|

| |||

Capital Markets |

|

|

|

|

| ||||||

ESG |

|

|

|

|

|

| |||||

Regulatory/Govt. Contracting |

|

|

|

|

|

|

|

|

| ||

HR/Compensation |

|

|

|

|

|

|

|

|

| ||

Operations/Risk Management |

|

|

|

|

|

|

|

| |||

Strategic Planning |

|

|

|

|

|

|

|

|

|

|

|

Technology/Innovation |

|

|

|

|

|

| |||||

Mergers and Acquisitions |

|

|

|

|

|

|

|

| |||

IT and Cyber |

|

|

|

|

|

|

| ||||

Corporate Governance/Ethics |

|

|

|

|

|

|

|

|

|

|

|

Demographics | |||||||||||

Race/Ethnicity | |||||||||||

African American |

| ||||||||||

Asian/Pacific Islander | |||||||||||

White/Caucasian |

|

|

|

|

|

|

|

|

|

| |

Hispanic/Latino | |||||||||||

Native American | |||||||||||

Gender | |||||||||||

Male |

|

|

|

|

|

|

| ||||

Female |

|

|

|

| |||||||

Board Tenure | |||||||||||

Years | 4 | 11 | 2 | 18 | 4 | 2 | 4 | 6 | 11 | 10 | 4 |

1 All Board members have public company and Executive Experience.

Board Independence

Nine of our current eleven Directors and all of our nominated Directors in 2021, are independent under our Corporate Governance Guidelines and applicable New York Stock Exchange (“NYSE”) listing standards. The Board has determined that Messrs. Holdsworth, Leer, McDew, McGovern, McMahon, Mitchell, and Wajsgras, and Mmes. Long, Lord and Vautrinot are independent under the independence criteria for directors established by the NYSE. As a result, we currently have a majority of independent Directors and satisfy the applicable rule of the NYSE.

Selection of Nominees for Election to the Board

Both the Corporate Governance and Responsibility Committee and the Board of Directors seek the talents and backgrounds that would be most helpful to Parsons in selecting nominees to the Board. In particular, the Corporate Governance and Responsibility Committee, when recommending director candidates to the full Board of Directors for nomination, may consider whether a director candidate, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience. In addition, our corporate governance guidelines provide that a director shall retire from our Board at the next annual meeting of stockholders after he or she has reached the age of 75.

Our Commitment to Board Diversity

The Board is committed to diversity and focuses on diversity in seeking new candidates to be considered for the Board. We currently have threefour female Directors (Ms. Long, Ms. Lord, Ms. Smith and Ms. Vautrinot) on the Board and one African American male (Mr. McDew).

Process for Stockholders to Recommend Director Nominees

Stockholders wishing to nominate a candidate for director at an annual meeting must (a) provide Timely Notice (as defined in Section 2.04(ii) of the Company’s bylaws) to the Secretary of the Corporation, (b) provide the information, agreements and questionnaires with respect to such stockholder and its candidate for nomination as required to be set forth in the Company’s Amended

and Restated Bylaws, and (c) provide any updates or supplements to such notice at the times and in the forms required by the Bylaws.

Director Orientation and Continuing Education

Each new member of the Board is provided with orientation materials and is required to attend meetings with the Executive Leadership team. In these meetings, discussion points included finance, legal, talent management and corporate strategy. In 2020,2023, the Board received presentations from internal and external sources and a list of continuing education opportunities to consider.

Any stockholder or other interested party may contact the Board, including any non-employee Director or the non-employee Directors as a group, or the ChairmanChair by writing to our corporate Secretary at 5875 Trinity Parkway #300, Centerville,14291 Park Meadow Drive, Suite 100, Chantilly, VA 20120.20151. In general, any stockholder communication delivered to our Corporate Secretary for forwarding to the Board, the ChairmanChair or a specified group of Board members will be forwarded in accordance with the stockholder’s instructions. However, our Corporate Secretary reserves the right not to forward to Board members any abusive, threatening or otherwise inappropriate materials.

Our Board has fourhad three standing Committees: An Executive Committee,Committees in 2023: an Audit and Risk Committee, a Compensation and Management Development Committee, and a Corporate Governance and Responsibility Committee. The charter of each Committee is available without charge on the Investor Relations portion of our website, www.parsons.com.www.parsons.com.

18

The following chart identifies the current members and chair of each standing Committee, as well as related information.

Audit and Risk Committee | Compensation & | Corporate |

| |

| ||||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

Gen. Darren W. McDew, USAF (ret) |

|

| ||

Harry T. |

|

|

| ||||

|

|

| ||

Carey A. Smith | ||||

Major General Suzanne M. “Zan” Vautrinot, USAF (ret) |

|

| ||

David C. Wajsgras |

|

|

| Committee Chair |

| Committee Member |

Committee Chair Committee Member

The following is a brief description of our Committees.

Executive Committee

The Executive Committee is responsible for providing our Board of Directors with considerations and recommendations regarding our business strategy. In addition, among other matters, the Executive Committee is responsible for reviewing key actions to be taken by us, such as major mergers, acquisitions, major investments or divestitures of assets outside our normal investment plans, and conducting periodic reviews of the Executive Committee’s performance, assessing the adequacy of its charter and recommending changes to the Board of Directors. The Executive Committee is authorized with all the powers of the Board of Directors, except for powers specifically denied by the Executive Committee charter, including, but not limited to, declaring or paying dividends, amending our bylaws or articles of incorporation, issuing stock and making or approving capital expenditures exceeding $5.0 million. The current members of our Executive Committee are Mr. Harrington (chairperson), Mr. McGovern, Mr. Holdsworth, Mr. Leer and Mr. Mitchell. Other than Mr. Harrington, all members of the Executive Committee are independent under our Corporate Governance Guidelines and applicable New York Stock Exchange (“NYSE”) listing standards.

The Executive Committee met twice during fiscal year 2020. A Pricing Committee appointed by the Board and comprised of Executive Committee and additional members also met one time during 2020 to review a convertible note transaction.

Audit and Risk Committee

Our Audit and Risk Committee oversees our corporate accounting and financial reporting process. Among other matters, the Audit and Risk Committee:

appoints our independent registered public accounting firm;

evaluates the independent registered public accounting firm’s qualifications, independence and performance;

determines the engagement of the independent registered public accounting firm;

reviews and approves the scope of the annual audit and the audit fee;

19

approves the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services;

monitors the rotation of partners of the independent registered public accounting firm on our engagement team in accordance with requirements established by the SEC;

reviews our financial statements and our management’s discussion and analysis of financial condition and results of operations to be included in our annual and quarterly reports to be filed with the SEC;

reviews our risk management procedures and risk factors affecting Parsons;

reviews our critical accounting policies and estimates;

reviews information and security operations and risk exposure; and

at least annually, reviews the Audit and Risk Committee charter and reviews and evaluates the performance of the Audit and Risk Committee and its members, including compliance by the Audit and Risk Committee with its charter.

The current members of our Audit and Risk Committee are Mr. Mitchell (chairperson), Mr. Leer, Ms. Long, Mr. McMahon, Ms. Vautrinot and Mr. Wajsgras. All members of the Audit and Risk Committee are independent under our Corporate Governance Guidelines and applicable New York Stock Exchange (“NYSE”) listing standards.

All members of our Audit and Risk Committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. Our Board of Directors has determined that M. Christian Mitchell, Steven F. Leer, and David C. Wajsgras are Audit and Risk Committee financial experts as defined under the applicable rules of the SEC and have the requisite financial sophistication as defined under the applicable rules and regulations of the NYSE. Under the rules of the SEC, members of the Audit and Risk Committee must also meet heightened independence standards. However, a minority of the members of the Audit and Risk Committee may be exempt from the heightened Audit and Risk Committee independence standards for one year from the date of effectiveness of the registration statement of which this prospectus forms a part. Our Board of Directors has also determined that each of the members are independent under the heightened Audit and Risk Committee independence standards of the SEC and the NYSE. The Audit and Risk Committee operates under a written charter that satisfies the applicable standards of the SEC and the NYSE.

The Audit and Risk Committee met eight times during fiscal year 2020.2023. The Audit and Risk Committee is briefed at least quarterly on information security operations mitigation measures to address risks related to Parsons’ global employees, information, and assets.

20

Compensation and Management Development Committee

Compensation Committee

Our Compensation and Management Development Committee reviews and recommends policies relating to compensation and benefits of our officers and employees. Among other matters, the Compensation and Management Development Committee:

reviews and approves corporate goals and objectives relevant to compensation of our chief executive officer and other executive officers;

evaluates the performance of these officers in light of those goals and objectives, and approves the compensation of these officers based on such evaluations;

approves the issuance of stock options and other awards under our long-term incentive plans, other than awards to non-employee members of our Board of Directors; and

at least annually, reviews the Compensation and Management Development Committee charter and reviews and evaluates the performance of the Compensation and Management Development Committee and its members, including compliance by the Compensation and Management Development Committee with its charter.

The current members of our Compensation and Management Development Committee are Mr. Leer (chairperson), Mr. Holdsworth, Ms. Lord, Mr. McDew, Mr. McMahon, Ms. Vautrinot and Mr. Wajsgras. All members of the Compensation and Management Development Committee are independent under our Corporate Governance Guidelines and applicable New York Stock Exchange (“NYSE”) listing standards.

Our Board of Directors has determined that each of the members of our Compensation and Management Development Committee is independent under the applicable rules and regulations of the NYSE and is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act. The Compensation and Management Development Committee operates under a written charter that satisfies the applicable standards of the SEC and the NYSE.

The Compensation and Management Development Committee met sixfive times during fiscal year 20202023 and also acted by written consent.

Corporate Governance and Responsibility Committee

The Corporate Governance and Responsibility Committee is responsible for making recommendations to our Board of Directors regarding candidates for directorships and the size and composition of our Board of Directors. All members of the Corporate Governance and Responsibility Committee are independent under our Corporate Governance Guidelines and applicable New York Stock Exchange (“NYSE”) listing standards.

The Corporate Governance and Responsibility Committee is responsible for overseeing our corporate governance policies and reporting, making recommendations to our Board of Directors concerning environment,environmental, social and governance (ESG) matters. The Corporate Governance and Responsibility Committee will also, at least annually, review its Committee charter and review and evaluate the performance of the Corporate Governance and Responsibility Committee and its members, including compliance by the Committee with its charter.

21

The current members of our Corporate Governance and Responsibility Committee are Ms. Vautrinot (chairperson), Mr. Holdsworth, (chairperson), Ms. Long, Ms. Lord, Mr. McDew, and Mr. McGovern, Mr. Mitchell and Ms. Vautrinot.Mitchell. Our Board of Directors has determined that each of the members of our Corporate Governance and Responsibility Committee is an independent director under the applicable rules and regulations of the NYSE relating to Corporate Governance and Responsibility Committee independence. The Corporate Governance and Responsibility Committee operates under a written charter that satisfies the applicable standards of the SEC and the NYSE.

The Corporate Governance and Responsibility Committee met sixfour times during fiscal year 2020.2023.

On January 1, 2020, our Board adopted stock ownership guidelines which provide for equity ownership guidelines for all our non-employee Directors to further align their interests to those of our stockholders. Under the policy, each of our non-employee Directors has five years from the later of (i) January 1, 2020 or (ii) the date of commencement of his/her service on the Board to achieve equity

ownership with a value equivalent to five times his/her annual cash retainer. In calculating a director’s ownership, common stock held by the non-employee director or an immediate family member, common stock owned indirectly if the individual has an economic interest in the shares or is a beneficial owner under RueRule 13d-3 of the Exchange Act, unvested RSUsRestricted Stock Units (RSUs) issued under the Parsons’ Incentive Plan and units held in deferral accounts by the Directors under the SVRPShare Value Retirement Plan (“SVRP”) will be considered owned by the non-employee director. Value of ownership will be measured by reference to the trailing 60 trading day weighted average of the Parsons common stock, up to and including last day of the calendar year; compliance will be evaluated annually. In the event of a significant decline in stock price, causing non-employee Directors holdings to fall below guideline levels, non-employee Directors will not be required to purchase additional stock. Determination of the impact of share price fluctuation is subject to Compensation and Management Development Committee discretion. In 2021, the Corporate Governance and Responsibility Committee adopted a resolution requiring the implementation of a Rule 10b5-1 trading plan for any director and member of the executive leadership team (reporting to the CEO) prior to being able to sell any shares of Parsons’ stock.

For a description of the guidelines applicable to executive officers, see our CD&A section of this Proxy.

Anti-Hedging and Anti-Pledging Policies

Under our Insider Trading Compliance Policy, we prohibit our employees, including our executive officers, and Board members, from hedging the risk associated with ownership of shares of our common stock and other securities, as well as from pledging any of our securities as collateral for a loan.

COMPENSATION AND MANAGEMENT DEVELOPMENT COMMITTEE INTERLOCKSINTERLOCKS AND INSIDER PARTICIPATION

The current members of our Compensation and Management Development Committee are Messrs. Leer, Holdsworth, McDew, McMahon, and Wajsgras and Ms. Vautrinot.Lord. No member of our Compensation and Management Development Committee serves who served on such committee during 2023 served as a member of the Board or Compensation and Management Development Committee of any other entity that has one or more executive officers serving as a member of our Board or Compensation and Management Development Committee.

23

SECURITY OWNERSHIP INFORMATION

Security Ownership of Directors and Executive Officers

The following table indicates information as of February 19, 202120, 2024 regarding the beneficial ownership of our common stock by each of our Directors, each of the named executive officers, and all of our Directors and executive officers as a group. Per our guidelines, 100% of the Board of Directors are permitted to own Parsons’ stock.

The percentages shown are based on 102,360,662105,829,579 shares of common stock outstanding as of February 19, 2021.20, 2024.

The amounts and percentages owned are reported on the basis of the SEC’s rules governing the determination of beneficial ownership of securities. The SEC’s rules generally attribute beneficial ownership of securities to each person who possesses, either solely or shared with others, the voting power or investment power, which includes the power to dispose of those securities. The rules also treat as outstanding all shares of capital stock that a person would receive upon exercise of stock options or warrants held by that person that are immediately exercisable or exercisable within 60 days. These shares are deemed to be outstanding and to be beneficially owned by the person holding those options for the purpose of computing the number of shares beneficially owned and the percentage ownership of that person, but they are not treated as outstanding for the purpose of

computing the percentage ownership of any other person. Under these rules, one or more persons may be a deemed beneficial owner of the same securities and a person may be deemed a beneficial owner of securities to which such person has no economic interest. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws as of February 19, 2021.20, 2024.

|

| Shares Beneficially |

|

| % of | ||||||||

|

| Shares |

|

| % |

|

| % | |||||

Named Executive Officers and Directors: |

|

|

|

|

|

|

|

|

|

| |||

Carey A. Smith(1)(2) |

|

| 307,501 |

|

| * |

|

| * |

|

| ||

Matthew Ofilos(1) |

|

| 36,446 |

|

| * |

|

| * |

|

| ||

Michael R. Kolloway(1)(2) |

|

| 76,181 |

|

| * |

|

| * |

|

| ||

Susan M. Balaguer(1)(2) |

|

| 28,958 |

|

| * |

|

| * |

|

| ||

George L. Ball(1)(2)(3) |

|

| 332,490 |

|

|

| — |

|

|

| — |

|

|

Mark K. Holdsworth |

|

| 22,110 |

|

|

| — |

|

|

| — |

|

|

Steven F. Leer |

|

| 22,110 |

|

|

| — |

|

|

| — |

|

|

Letitia A. Long |

|

| 17,367 |

|

|

| — |

|

|

| — |

|

|

Ellen M. Lord |

|

| 6,789 |

|

|

| — |

|

|

| — |

|

|

Darren W. McDew, General USAF (ret) |

|

| 17,367 |

|

|

| — |

|

|

| — |

|

|

Harry T. McMahon |

|

| 27,110 |

|

|

| — |

|

|

| — |

|

|

M. Christian Mitchell |

|

| 22,110 |

|

|

| — |

|

|

| — |

|

|

Major General Suzanne M. “Zan” Vautrinot, USAF (ret) |

|

| 22,110 |

|

|

| — |

|

|

| — |

|

|

David C. Wajsgras |

|

| 28,528 |

|

|

| — |

|

|

| — |

|

|

All executive officers and directors as a group (16 persons)(4) |

|

| 967,176 |

|

| * |

|

| * |

|

| ||

5% Stockholders: |

|

|

|

|

|

|

|

|

|

| |||

Parsons Corporation Employee Stock Ownership Plan |

|

| 59,222,217 |

|

|

| 56.0 | % |

|

| 56.0 | % |

|

* less than 1%.

|

| Shares Beneficially Owned |

|

| % of Outstanding Shares Beneficially Owned | |||||||||

|

| Shares |

|

| % |

|

| % | ||||||

Named Executive Officers and Directors: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Charles L. Harrington(1)(2) |

|

| 154,758 |

|

| * |

|

|

| * |

|

| ||

George L. Ball(3) |

|

| 146,726 |

|

| * |

|

|

| * |

|

| ||

Carey A. Smith(1)(2) |

|

| 19,169 |

|

| * |

|

|

| * |

|

| ||

Michael R. Kolloway(1)(2) |

|

| 20,030 |

|

| * |

|

|

| * |

|

| ||

Debra A. Fiori(1)(2) |

|

| 21,313 |

|

| * |

|

|

| * |

|

| ||

Kenneth C. Dahlberg |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

Mark K. Holdsworth |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

Steven F. Leer |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

Letitia A. Long |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

Darren W. McDew, General USAF (ret) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James F. McGovern |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

Harry T. McMahon |

|

| 25,800 |

|

|

| — |

|

|

|

| — |

|

|

M. Christian Mitchell |

|

| — |

|

|

| — |

|

|

|

| — |

|

|

Major General Suzanne M. “Zan” Vautrinot, USAF (ret) |

|

|

|

|

|

| — |

|

|

|

| — |

|

|

David C. Wajsgras |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All executive officers and directors as a group (12 persons)(4) |

|

| 387,796 |

|

| * |

|

|

| * |

|

| ||

5% Stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Parsons Corporation Employee Stock Ownership Plan |

|

| 76,076,020 |

|

|

| 74.3 | % |

| 74.3% | ||||

24

|

|

|

|

|

|

|

|

|

|

DELINQUENT SECTION 16(A) REPORTS